How to make rejection suck, a little less

“We like you, but don't know if this is a fit for us”

😣Ouchh, we founders hate the sting of getting rejected by investors. Especially because most investors don't actually explicitly reject you.

Why you need to understand Investor herd dynamics?

Most founders don't succeed in fundraising because they don't understand the investor herd dynamics. Investors are social animals; they feel more comfortable being part of a group than being the lone wolf.

How to sell your company for hundreds of millions, in 4 easy steps

STEP 1: Have a great team. At an early stage, investors are taking a chance on how great the team is, not the market, not the product, or even your traction

I wrote a screenplay, that no one read, but it helped me in fundraising

When I was at Wharton, I took a screenwriting class and wrote a screenplay. It wasn't great, no one read it ☹️ but I learned lots of things that I later applied to VC fundraising. Here it is…

5 steps to fundraise without losing your mind_Pt 5

Step 5: Be formidable

So by now, you know how much money you need, you have your 60-second pitch locked, you have your deck on point, and you have your investor process game plan.

5 steps to fundraise without losing your mind_Pt 4

Step 4: Prepare a process

In fundraising, time is your enemy. This is because your startups’ attractiveness to investors has an expiration date. The longer you’re out fundraising, the lower your chances.

5 steps to fundraise without losing your mind_Pt 3

Step 3: Build a killer deck

Once you’ve nailed your 60-second pitch, building a deck is easy. That's because the deck should reflect your 60-second pitch. Let's go slide by slide:

5 steps to fundraise without losing your mind_Pt 2

Step 2: Nail your 60 second pitch

The constraint of having to pitch your company in 60 seconds, is a forcing function for actually defining what you actually do.

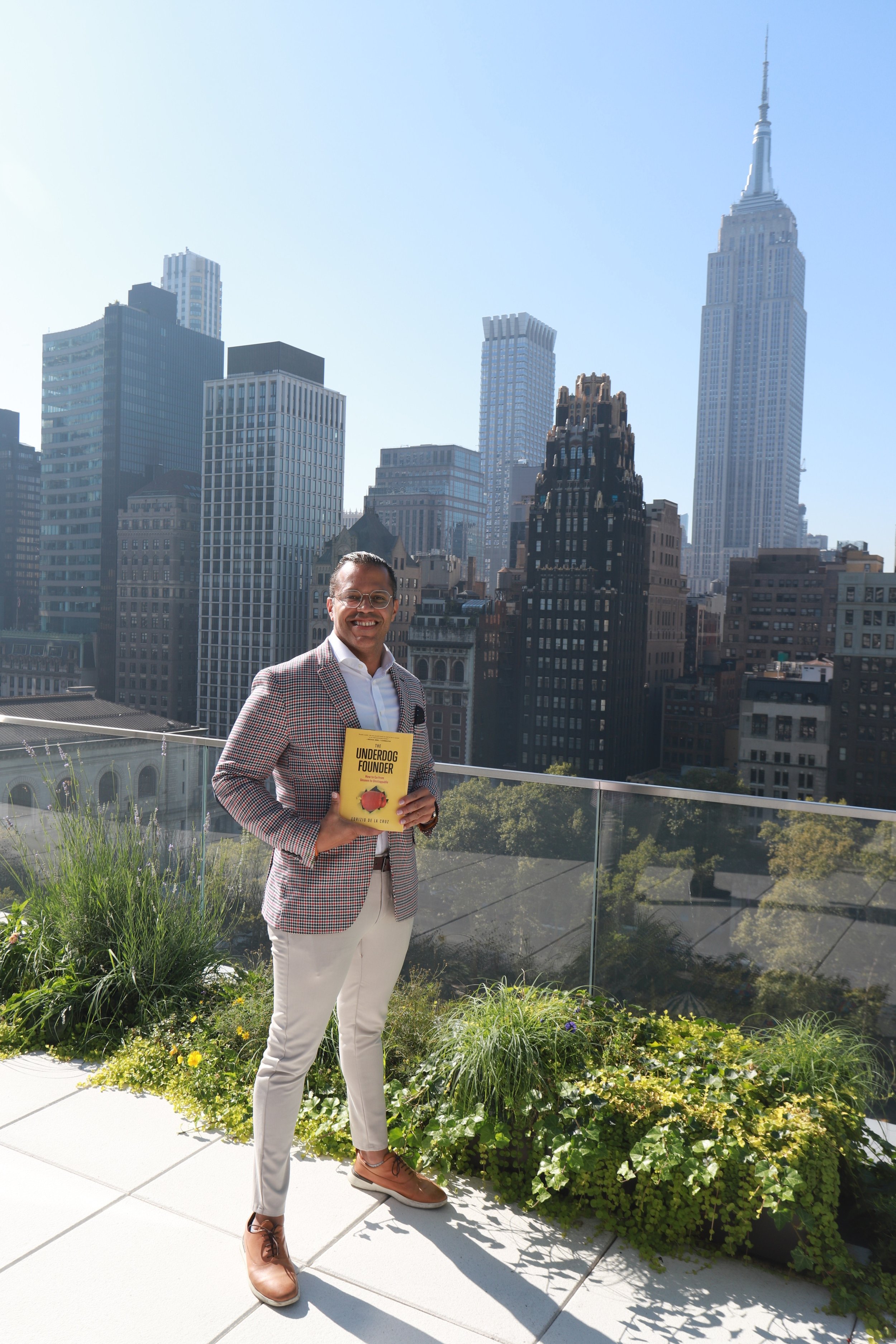

You should treat fundraising like a sport

During my tenure at our previous startup, we engaged with a whopping 144 investors prior to securing our series A funding. While I initially believed our journey was unique, I've since discovered that our experience aligns more closely with the norm.